Download full white paper: https://openinsuranceobs.com/reports/report-embedded-insurance-in-the-age-of-cx/

The rise in CX maturity in insurance

Advancing technologies and powerful data analytics are changing the way consumers and brands interact. From targeted marketing to personalised product design, and from frictionless sales to 24/7 servicing – consumer expectations are shifting – and rising. And savvy brands are using the tools now at their disposal to not just meet these expectations, but to exceed them.

The most successful brands understand their customers and know how to engage – and delight – them. And the insurance industry is no longer an exception. With the wider transition to an ‘experience economy’, innovative insurers are investing in technology – and creating partnerships – that are allowing them to differentiate themselves and gain market share in an increasingly customer-centric environment.

The pandemic was certainly a push factor towards greater CX maturity in insurance, but the momentum isn’t slowing. International Data Corporation predicts global IT spending in insurance will grow at a CAGR of 6% by next year, reaching $135 billion – with CX accounting for 37% of this investment.

Embedded insurance and CX – The business case

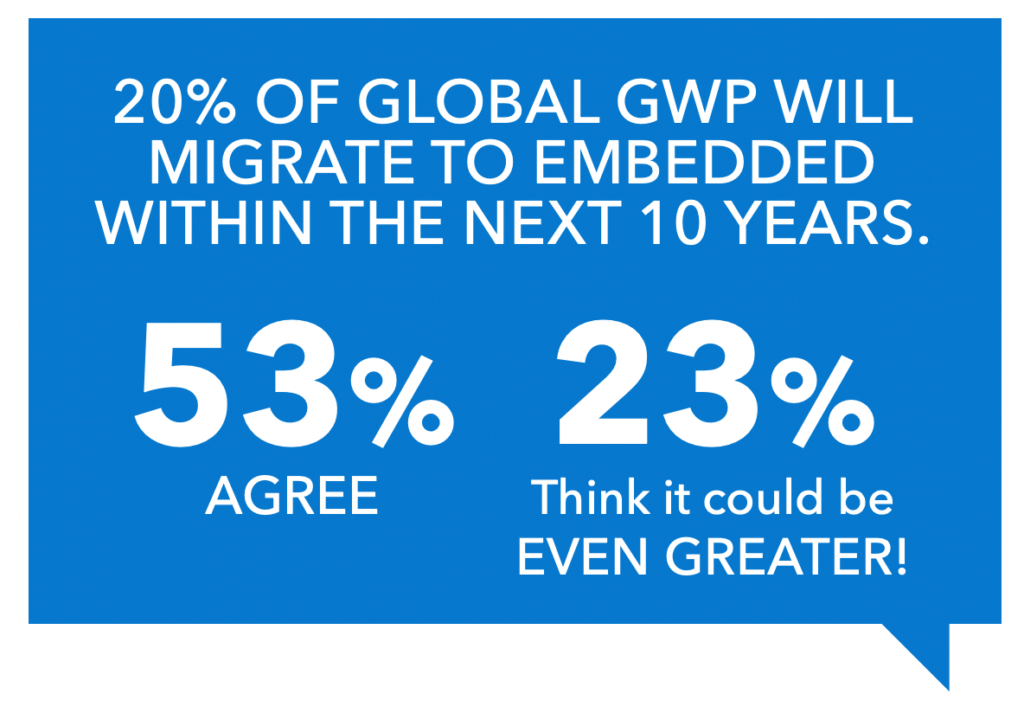

One of the most important shifts in global insurance in recent times is well underway – and that’s the seamless integration of insurance offers into customer journeys. Non-insurance brands are increasingly embedding insurance offerings into their digital ecosystems – increasing customer confidence, driving sales, and raising customer satisfaction. The Open and Embedded Insurance Observatory estimates that approximately 20% of global GWP will migrate to embedded within the next 10 years. With our survey results showing that 53% ‘agree’ with this figure, and 23% believe the migration to embedded ‘could be even greater’ – the importance of such solutions can no longer be ignored by insurers who want to remain relevant.

In terms of the impact of providing embedded insurance solutions on their business, it’s also encouraging to report that none of our survey respondents said it had had a ‘negative’ effect on their business. And no insurers agreed that their embedded solutions were cannibalising their standard insurance lines – with only a very small minority saying it was doing this to ‘a certain extent’.

In fact, 50% of insurers reported that providing embedded insurance has already led to lower loss ratios. And 70% of respondents said that providing embedded insurance had had a positive effect on their business – with 22% saying it has been a ‘game-changer’.

Download full white paper here: https://openinsuranceobs.com/reports/report-embedded-insurance-in-the-age-of-cx/