Source: Strategy& by Dr. Gero Matouschek, Jens Langkammer, and Christoph Herzog

To put this figure into context: the global GWP volume in P&C across all distribution channels amounted to EUR 1.8tr in 2022 according to the Allianz Global Insurance Report 20231. This underlines the high potential of Embedded Insurance for the whole insurance industry. But what is the motivation for companies whose primary and traditional focus is selling cars or wholesale products to engage in the insurance sphere?

This is not only to strengthen customer loyalty and enrich their consumer data, but also to create new and diversified sources of income. Through the mostly commission-based cooperation model with insurance companies, the adjacent revenue stream of Embedded Insurance offerings comes with low fixed costs – an apparent sure-fire strategy.

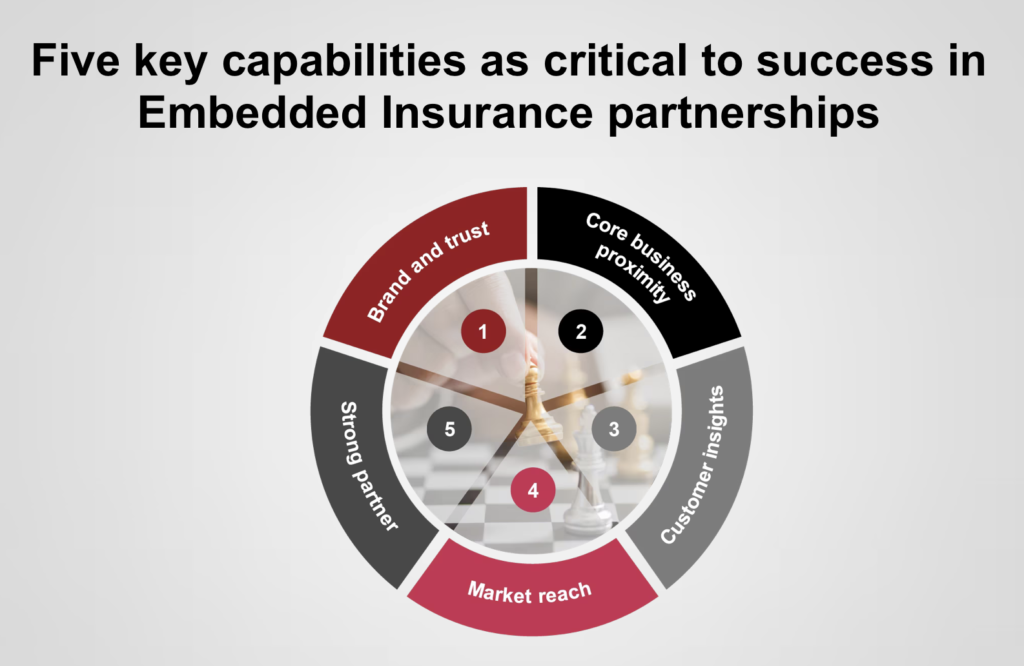

Strategy& have identified five key capabilities as critical to success in Embedded Insurance partnerships:

- Brand and trust

A strong, trusted brand, defined as the accumulation of generated customer value, is the entry ticket to sell insurance products. Recent customer survey data shows that confidence in and loyalty to brands are the main drivers of willingness to buy insurance through non-Financial Services companies. The stronger the dedicated brand positioning, the more targeted the insurance offering can be to capture the customer’s interest. - Core business proximity

Proximity between product or service offering and insurance solutions makes it easier to access the market. Add-on products in line with their own value proposition, such as the classical example of OEMs providing car insurance, reinforce the consumer’s trust in the insurance offering. - Customer insights

Insight into consumer purchasing behavior significantly helps to integrate insurance offerings successfully and seamlessly. This means setting the right triggers at the right time during the customer journey, fueled by existing knowledge of consumer behavior. - Market reach

Broad market reach and frequent customer interaction build a strong foundation to first generate awareness and ultimately covert it into sales. This holds especially true when online and offline touchpoints are used in a complementary way in the insurance sales journey. - Strong partner

A strong, experienced insurance partner not only taking responsibility for establishing and operating the insurance infrastructure as well as claims handling, but also to invest in a partner-specific, targeted insurance offering.

Read full article: https://www.strategyand.pwc.com/de/en/industries/financial-services/embedded-insurance.html