Download full white paper: https://openinsuranceobs.com/reports/report-embedded-insurance-in-the-age-of-cx/

Data analytics and machine learning gives insurance providers the opportunity to test where best to place an insurance offering within a customer journey for maximum conversion, and how to differentiate these offers throughout the journey. It empowers underwriting, allowing for real-time offers of personalised – and hyerpersonalised – insurance protection. And it provides opportunities for up-selling and cross-selling to increase wallet share.

Consumers are now actively seeking this personalized experience when buying insurance. And through the sharing of data between insurers and their tech and distribution partners – CX in this sector will continue to be transformed.

Beyond seamless and intuitive CX, predictive analytics is now taking the customer experience to another level – allowing insurers to proactively offer customer support and solve CX problems in real time. By anticipating customer behaviours, insurers can better connect with their customers, improving satisfaction rates and boosting revenue per customer.

Sharing is caring

Encouragingly, our survey showed that 83% of enablers have access to data from their distribution partners that is generated from their embedded partnership. However, 54% don’t have access to partner data that isn’t related to the embedded insurance activity.

This shows a clear opportunity to work more closely with distribution partners to establish greater access to wider data pools that would benefit both parties and, ultimately, customers. Explaining to customers the value of sharing their data, and how it would improve their experience is a valuable process – as is explaining the services and offers they wouldn’t have access to by opting out of data sharing.

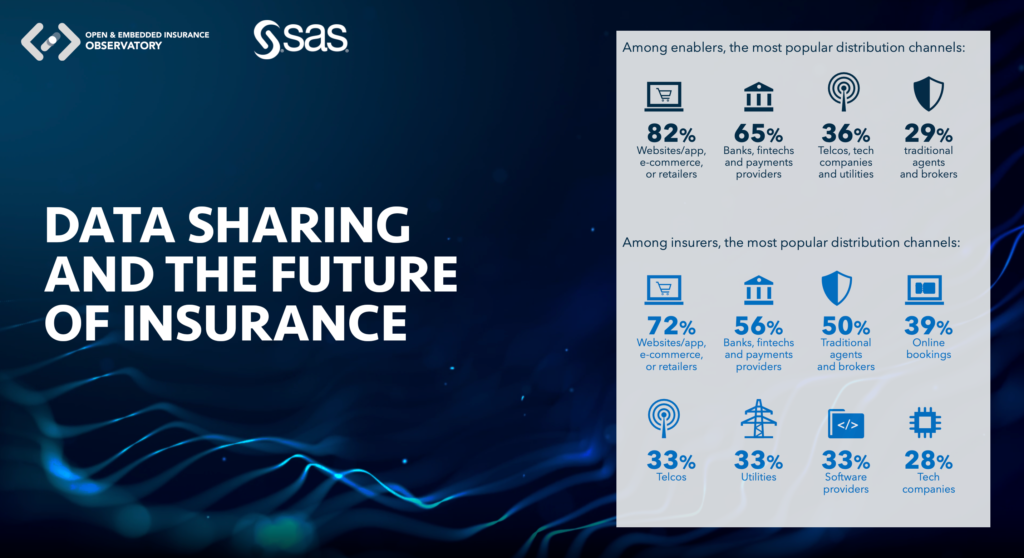

In terms of the most popular channels for distributing embedded insurance products, our survey showed a wide variety.

Among enablers, the most popular channels are websites/ app, e-commerce, or retailers – which together total 82% of respondents. Followed by banks, fintechs and payments providers (65%), telcos, tech companies and utilities companies (all at 36%), and traditional agents and brokers (29%).

Among insurers, the most popular distribution channels are – similarly – apps/websites, e-commerce or retailers (72%), followed by banks, fintechs and payments providers (56%), traditional agents or brokers (50%), online bookings (39%), telcos (33%), utilities companies (33%), software providers (33%), and tech companies (28%).

Some of the other channels used by both enablers and insurers are manufacturers, educational organisations, associations, NGOs, superapps, and software providers.

This illustrates the broad spectrum of non-insurance businesses that are now adding insurance as a core part of their value proposition. By bridging existing data gaps, we’ll see yet more organizational types embedding insurance solutions – and we’ll see growth in the percentage of existing non-insurance sectors creating protection products that very specifically meet the needs of their valued customers.

Download full whitepaper: https://openinsuranceobs.com/reports/report-embedded-insurance-in-the-age-of-cx/