Source: Chubb

E-commerce transactions and deliveries are often at the mercy of unforeseen conditions, and consumers need to be assured that their purchases are protected, regardless of what happens. E-sellers also need assurances that their transactions and businesses will be protected as online sales grow. That’s why insurance can become a vital foundation to the e-commerce product and service lifecycle.

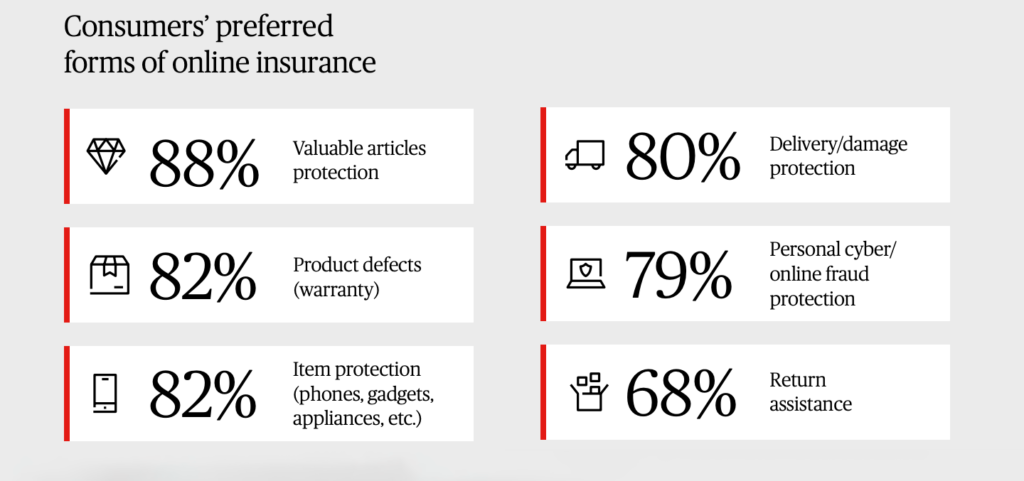

Consumers are already used to seeing offers for insurance on purchases like travel. Coverage options can be as simple as one click during a purchase. Close to one third of consumers, 32%, say they are willing to pay up to 5% of the total cost of their transactions for relevant insurance coverage. Insurance is about more than just compensation, it’s about creating a positive experience for consumers. “What happens if a purchased item gets lost or stolen?” says Lazaro. “How can we ensure the experience is good? How can we help the consumer have peace of mind?”

The key is to view the customer experience not as a one-off transaction, but as a continuous commitment that extends from initial marketing to customer use of the product or service, says McNeece. “E-sellers need to consider all aspects of the lifecycle, from acquisition all the way through the culmination of the experience.”

Read full report: https://about.chubb.com/stories/online-retail-trust-report.html