Source: Fintech Singapore

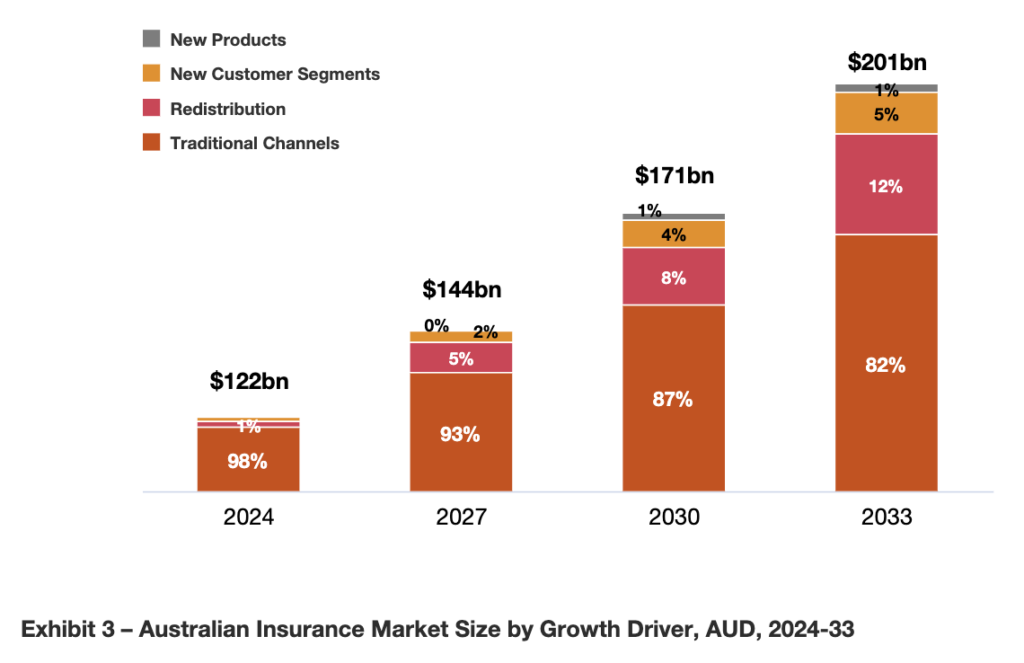

This growth is projected to be substantial, with PwC estimating that gross written premiums (GWP) generated with embedded insurance will grow by 34% annually between 2024 and 2033. This rate surpasses the estimated 4% annual growth rate for traditional insurance channels during the same period.

These figures suggest that embedded finance is set to account for A$35.3 billion, or 18% of the total Australian insurance market worth A$210 billion in GWP by 2033, up by a staggering 1,370% from the market’s estimated A$2.4 billion in GWP in 2024.

Across the main types of insurance, the general insurance segment is expected to witness the greatest adoption of embedded finance. Between 2024 and 2033, general insurance distributed through embedded channels is projected to see its share soar from 1% to 12%. The category will be followed by health insurance and life insurance, which are set to grow from 0% to 3%, and from 0% to 2%, respectively.

Read full article: https://fintechnews.sg/95562/australia/embedded-insurance-australia/