Source: McKinsey

Revenues from embedded finance (EF)—the delivery of financial products by nonfinancial entities within their broader offerings—could surpass €100 billion in Europe by the end of the decade, according to McKinsey forecasts. The distribution of financial products and services, such as loans and insurance, in third-party channels is gaining importance as technology and data allow for instant and seamless customer journeys, and customers increasingly expect to find financial services when and where they need them, such as during a large purchase.

In many sectors, customers have come to expect merchants and other consumer and small and medium-size enterprise (SME) platforms to provide EF products and services. Meantime, banks are starting to see the importance of EF as a distribution channel. This article describes how the EF industry is developing and how customer platforms can respond to the demand and win market share.

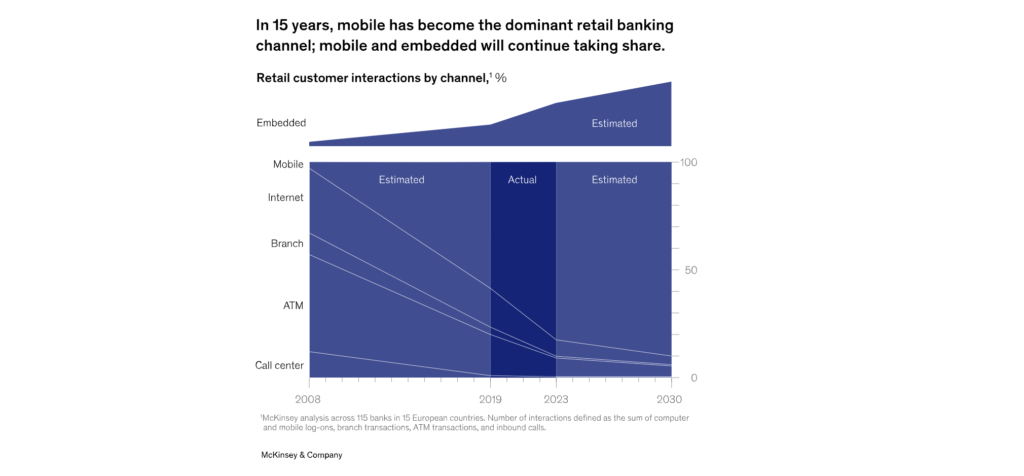

With increasing customer pull and better delivery tools, EF likely will continue to grow and affect virtually every sector through the rest of the decade. By 2030, 10 to 15 percent of banks’ revenues and 20 to 25 percent of retail and SME lending revenues may originate in EF, and total European EF revenues could reach €100 billion. Given this potential, companies and banks can gain from examining how they might deploy embedded finance.

Read full article: https://www.mckinsey.com/industries/financial-services/our-insights/embedded-finance-how-banks-and-customer-platforms-are-converging